Investor wealth has more than doubled as a result of Trent’s share price growth of 105% over the past six months. In comparison, the benchmark index, Nifty 50, has risen by about 12 percent throughout the same period.

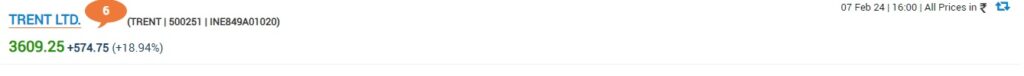

The shares of retail player Trent surged more than 20 percent in trading on February 7 following the company’s announcement of a consolidated net profit of Rs 370.6 crore for the December quarter of FY24, up 39.4% from Rs 154.81 crore in the same quarter of the previous financial year.

The stock surged 15% on the BSE, reaching a peak of Rs 3,489.65. Comparing the quarter’s revenue to the same period the previous year, it increased by 50.50 percent to Rs 3,466.62 crore from Rs 2,303.38 crore.

Our lifestyle offerings saw significant growth in Q3FY24 across concepts, categories, and channels. Greater operating synergies are clearly made possible by the expanding scope of our businesses. As Chairman Noel N. Tata stated, “We continue to see growing relevance for our offerings, resilience in our business model choices, and attractiveness of our differentiated platform.”

Trent said that, compared to the same quarter last year, their operating EBIT margin for Q3FY24 is 13%, up from 8.5%. Trent has 28 stores spanning lifestyle ideas, 460 Zudio, and 227 Westside stores.

According to Noel, his business will keep growing and strengthening its retail presence. Our strategic differentiators, we think, will keep giving us positive tailwinds. We’ve used our playbook to the Star business, and the positive consumer feedback we’re receiving strengthens our resolve to expand this development engine into the grocery and food industries. He expressed confidence in the company’s ability to change course and provide significant value to both customers and shareholders in the future.

50 Zudio stores and 5 Westside stores were added during the quarter, spanning 36 cities, including 13 new ones.